UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under $240.14a-12 | |

HELIOS TECHNOLOGIES, INC.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth

the

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

|

Dear Shareholders:

The year of 2020 was a watershed year for Helios on many levels. What helps keep companies anchored through challenging times is being able to lean into a shared corporate purpose. A purpose statement should help provide context for our strategy, be easy to remember, and help inspire each other, as well as our partners. It is meant to act as our compass, and to help guide each of us in making better decisions as a leader. It should also describe who we are when we are at our best.

We have recently developed a purpose statement that we feel connects Helios to its valued customers, shareholders, employees and stakeholders: |

Our trusted global brands deliver technology solutions that ensure safety, reliability, connectivity and control.

This is a succinct statement, but if you look at each word in this sentence, you will see deep meaning and connection points across our businesses. As we reflect on how we did business through 2020 and plan our business goals for 2021 and beyond, we will reference and incorporate this purpose statement.

We have also been working with the core values of our subsidiaries (those that formally had them) to find common connection points to also bring us together under one “corporate umbrella.” We have identified “The Helios Shared Values” which are not meant to replace any of our subsidiaries’ individual core values, but rather reinforce as well as be the common thread that unites us. I am proud of the Shared Values set forth in the graphic below. This framework will help all of us continue to create and cultivate the strong, deeply rooted, values-based culture that will carry us to our many corporate milestones to come.

Our Shared Values are the foundation of our corporate culture. This shines through as you read our proxy and understand how our employees pulled together and performed so well while supporting each other and our communities during the very challenging year of 2020.

You are cordially invited to attend the Helios Technologies (“Helios”) Annual Meeting of Stockholders on June 3, 2021 at 10:00 a.m. (Eastern Daylight Time), at the offices of Helios Technologies, 7456 16th Street East, Sarasota, FL 34243. All Helios stockholders of record at the close of business on April 6, 2021 are welcome to attend the Annual Meeting, but it is important that your shares are represented at the Annual Meeting even if you do not plan to attend. To ensure you will be represented, as soon as possible please vote by telephone, mail, or online.

With COVID-19 top of mind, we will continue to take precautionary measures to ensure the health and well-being of our employees, visitors and communities and ask that you also make a safe, comfortable choice regarding whether to attend our in-person meeting. On behalf of the Board of Directors and our leadership team, I would like to express our appreciation for your continued interest in and support of Helios Technologies.

Sincerely,

Josef Matosevic

President & CEO

Helios Technologies, Inc.

HELIOS TECHNOLOGIES, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Thursday, June 3, 2021

Notice is hereby given that the Annual Meeting of Shareholders of Helios Technologies, Inc., a Florida corporation, will be held on Thursday, June 3, 2021 at 10:00 a.m. (Eastern Daylight Time) at the offices of Helios Technologies, 7456 16th Street East, Sarasota, FL 34243* for the following purposes:

| 1. | To elect two Directors to serve until the Annual Meeting in 2024, both of whom shall serve until their successors are elected and qualified or until their earlier resignation, removal from office or death; |

| 2. | To ratify the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for the year 2021; |

| 3. | To conduct an advisory vote on executive compensation; and |

| 4. | To transact such other business as properly may come before the Meeting or any adjournment thereof. |

Shareholders of record at the close of business on April 6, 2021 (referred to herein as the “record date”), are entitled to receive notice of and to vote at the Meeting and any adjournment thereof.

We sent a Notice of Internet Availability of Proxy Materials on or about April 23 2021, and provided access to our proxy materials over the Internet beginning April 23, 2021, for the holders of record and beneficial owners of our common stock as of the close of business on the record date. If you received a Notice of Internet Availability by mail, you will not receive a printed copy of the proxy materials in the mail. Instead, the Notice of Internet Availability instructs you on how to access and review this proxy statement and our annual report and authorize a proxy online to vote your shares. If you received a Notice of Internet Availability by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability.

If your shares are held in street name by a brokerage, your broker will supply the Notice of Internet Availability instructions on how to access and review this proxy statement and our annual report and authorize a proxy online to vote your shares. If you receive paper copies of the materials from your broker by mail, please mark, sign, date and return your proxy card to the brokerage. It is important that you return your proxy to the brokerage as quickly as possible so that the brokerage may vote your shares. You may not vote your shares in person at the Meeting unless you obtain a power of attorney or legal proxy from your broker authorizing you to vote the shares, and you present this power of attorney or proxy at the Meeting.

By Order of the Board of Directors,

Melanie M. Nealis

Secretary

Sarasota, Florida

April 23, 2021

* As part of our precautions regarding the COVID-19 pandemic, we are planning for the possibility that the Meeting may be held solely by means of remote communications. If we take this step, we will announce the decision to do so in advance, and details on how to participate, including details on how to inspect a list of shareholders of record, will be posted on our website and filed with the Securities and Exchange Commission as proxy material.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE SHAREHOLDERS MEETING TO BE HELD ON JUNE 3, 2021

This Proxy Statement and our 2021 Annual Report to Shareholders are available at: www.viewproxy.com/HeliosTechnologies/2021 and https://ir.heliostechnologies.com.

| Page | ||||

| 1 | ||||

| 3 | ||||

| 4 | ||||

|

|

4 |

| ||

| Board Leadership Structure and the Board’s Role in Risk Oversight |

|

11 |

| |

|

|

11 |

| ||

|

|

14 |

| ||

|

|

15 |

| ||

|

|

15 |

| ||

|

|

15 |

| ||

|

|

15 |

| ||

|

|

15 |

| ||

| 28 | ||||

| 29 | ||||

| Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters |

30 | |||

| 32 | ||||

|

|

32 |

| ||

|

|

32 |

| ||

|

|

33 |

| ||

|

|

33 |

| ||

|

|

36 |

| ||

|

|

36 |

| ||

|

|

39 |

| ||

|

|

44 |

| ||

|

|

46 |

| ||

|

|

48 |

| ||

| 49 | ||||

|

|

50 |

| ||

|

|

52 |

| ||

|

|

53 |

| ||

|

|

54 |

| ||

|

|

54 |

| ||

|

|

54 |

| ||

|

|

54 |

| ||

|

|

55 |

| ||

|

|

56 |

| ||

|

2021 Proxy Statement | i |

|

Table of Contents |

| Page | ||||

| 58 | ||||

|

|

59 |

| ||

| Proposal 2 — Ratification of the Appointment of Independent Registered Public Accounting Firm |

60 | |||

| 61 | ||||

| 61 | ||||

| 62 | ||||

| ii | 2021 Proxy Statement |

|

HELIOS TECHNOLOGIES, INC.

1500 West University Parkway

Sarasota, Florida 34243

This proxy overview is a summary of information that you will find throughout this proxy statement. As this is only an overview, we encourage you to read the entire proxy statement, which was first distributed to our shareholders on or about April 23, 2021.

2021 ANNUAL MEETING OF SHAREHOLDERS

| Time and Date: | Thursday, June 3, 2021, at 10:00 a.m. Eastern Daylight Time | |

| Place: | Helios Technologies, Inc. 7456 16th Street East Sarasota, FL34243 | |

| Record Date: | April 6, 2021 | |

| Voting: | Shareholders as of April 6, 2021 (the “record date”) may vote on or before 11:59 p.m. Eastern Daylight Time on June 2, 2021 for shares held directly and by 11:59 p.m. Eastern Daylight Time on May 31, 2021 for shares held in a Plan through one of the following options: | |

|

By completing, signing and dating the voting instructions in the envelope provided |

By the internet at www.fcrvote.com/HLIO |

By telephone at 1-866-402-3905 |

In person by completing, signing and dating a ballot at the annual meeting |

Any proxy delivered pursuant to this solicitation may be revoked, at the option of the person executing the proxy, at any time before it is exercised by delivering a signed revocation to the Company, by submitting a later-dated proxy or by attending the meeting in person and casting a ballot. If proxies are signed and returned without voting instructions, the shares represented by the proxies will be voted as recommended by the Board of Directors (the “Board”). If you are a shareholder of record, you may vote by granting a proxy. Specifically, you may vote:

| • | By Internet—If you have Internet access, you may submit your proxy by going to www.fcrvote.com/HLIO and by following the instructions on how to complete an electronic proxy card. You will need the 16-digit number included on your Notice or your proxy card in order to vote by Internet. |

| • | By Telephone—If you have access to a touch-tone telephone, you may submit your proxy by dialing 1-866-402-3905 and by following the recorded instructions. You will need the 16-digit number included on your Notice or your proxy card in order to vote by telephone. |

| • | By Mail—You may vote by mail by returning the card in the envelope that will be provided to you. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example, as guardian, executor, trustee, custodian, attorney or officer of a corporation), indicate your name and title or capacity. |

| • | In Person—You may vote by attending the Meeting in person and casting a ballot. |

The cost of soliciting proxies will be borne by the Company. In addition to the use of the mail, proxies may be solicited personally, by internet or by telephone by regular employees of the Company. The Company does not expect to pay any compensation for the solicitation of proxies, but may reimburse brokers and other persons holding stock in their names, or in the names of nominees, for their expense in sending proxy materials to their principals and obtaining their proxies. The approximate date on which this Proxy Statement and enclosed form of proxy first has been mailed or made available over the Internet to shareholders is as of April 23, 2021.

|

2021 Proxy Statement | 1 |

|

PROXY STATEMENT |

The close of business on April 6, 2021, has been designated as the record date for the determination of shareholders entitled to receive notice of and to vote at the Meeting. As of April 6, 2021, 32,233,465 shares of the Company’s Common Stock, par value $.001 per share, were issued and outstanding. Each shareholder will be entitled to one vote for each share of Common Stock registered in his or her name on the books of the Company on the close of business on April 6, 2021, on all matters that come before the Meeting. Abstentions will be counted as shares that are present and entitled to vote for purposes of determining whether a quorum is present. Shares held by nominees for beneficial owners will also be counted for purposes of determining whether a quorum is present if the nominee has the discretion to vote on at least one of the matters presented, even though the nominee may not exercise discretionary voting power with respect to other matters and even though voting instructions have not been received from the beneficial owner (a “broker non-vote”). Abstentions and broker non-votes are not counted in determining whether a proposal has been approved.

We intend to hold our Meeting in person. However, as part of our precautions regarding the COVID-19 pandemic, we are planning for the possibility that the Meeting may be held solely by means of remote communications. If we take this step, we will announce the decision to do so in advance, and details on how to participate will be posted on our website and filed with the Securities and Exchange Commission (“SEC”) as proxy material.

| 2 | 2021 Proxy Statement |

|

PROPOSAL 1 — ELECTION OF DIRECTORS

The Board of the Company will consist of eight members (presently nine members). The Board is divided into three classes of Directors serving staggered three-year terms. Directors hold their positions until the annual meeting of shareholders in the year in which their terms expire, and until their respective successors are elected and qualified or until their earlier resignation, removal from office or death.

The term of office of three of the Company’s current nine directors – Josef Matosevic, Gregory Yadley, and Kennon Guglielmo – will expire at the Meeting. Dr. Guglielmo will not be nominated for reelection. The Board would like to express its sincere gratitude to Dr. Guglielmo for his years of service on the Helios Board.

The Governance and Nominating Committee of the Board has selected Mr. Matosevic and Mr. Yadley to stand for reelection to the Board at the Meeting, to serve until the Company’s annual meeting in 2024. In making its nominations of Mr. Matosevic and Mr. Yadley, the Governance and Nominating Committee reviewed the backgrounds of the two individuals and believes that each of them (as well as each other continuing Director whose term does not expire at the Meeting) has valuable individual skills and experiences that, taken together, provide the Company with the diversity and depth of knowledge, judgment and vision necessary to provide effective oversight.

Biographical information for each of the nominees is set forth below under “Directors and Executive Officers.”

Shareholders may vote for up to two nominees for the class of Directors who will serve until the Company’s annual meeting in 2024. If a quorum is present at the meeting, Directors will be elected by a plurality of the votes cast. Shareholders may not vote cumulatively in the election of Directors. In the event either of the nominees should be unable to serve, which is not anticipated, the proxy committee, which consists of Alexander Schuetz and Philippe Lemaitre, will vote for such other person or persons for the office of Director as the Board may recommend.

|

|

The Board of Directors recommends that you vote “FOR” Mr. Matosevic and Mr. Yadley to serve until the Company’s annual meeting in 2024. |

|

2021 Proxy Statement | 3 |

Directors and Executive Officers

The following table sets forth the names and ages of the Company’s current directors and current executive officers and the positions they hold with the Company. Executive officers serve at the pleasure of the Board.

| Name/Age/Independence

|

Director Since

|

Committee Membership (C: Chair)

| ||||||||||||

| Biographies

|

Audit

|

Comp.

|

Nom.

|

ESG

| ||||||||||

|

Philippe Lemaitre, 71 Independent Director and Chairman of the Board |

June 2007 |

Philippe Lemaitre retired in November 2006 as Chairman, President and Chief Executive Officer of Woodhead Industries, Inc., a publicly held automation and electrical products manufacturer, upon its sale to Molex. Before joining Woodhead in 1999, Mr. Lemaitre was Corporate Vice President and Chief Technology Officer of AMP, Inc. and had responsibility for AMP Computer and Telecom Business Group Worldwide. Prior to joining AMP, Mr. Lemaitre was an Executive Vice President of TRW, Inc. and also General Manager of TRW Automotive Electronics Group Worldwide. He previously held various management and research engineering positions with TRW, Inc., International Technegroup, Inc., General Electric Company and Engineering Systems International. Mr. Lemaitre also served as Chairman of the Board of Directors of Multi-Fineline Electronix, Inc. from March 2011 until the sale of the company in July 2016. Mr. Lemaitre holds a Master of Civil Engineering degree from Ecole Spéciale des Travaux Publics, Paris, France, and a Master of Science degree from the University of California at Berkeley, California. Mr. Lemaitre has served as a Director of the Company since June 2007, and as Chairman of the Board since June 2013. Mr. Lemaitre’s more than 35 years of experience in the development of technology and with technology-driven businesses, his track record of successfully managing global business functions including sales, engineering, research and manufacturing operations, and his role as Chairman of another public company provide a wealth of experience in key areas of the Company’s business and governance. |

● | ||||||||||

|

Marc Bertoneche, 74 Independent Director |

August 2001 |

Marc Bertoneche is an Emeritus Professor in Business Administration at the University of Bordeaux in France, and was on the Faculty of INSEAD, the European Institute of Business Administration in Fontainebleau, France, for more than 20 years. He was a Visiting Professor of Finance at the Harvard Business School. He is an Associate Fellow at the University of Oxford and a Distinguished Visiting Professor at HEC Paris. Dr. Bertoneche is a graduate of University of Paris and earned his MBA and PhD from Northwestern University. He has served as a Director of the Company since August 2001. Dr. Bertoneche has 40 years of teaching corporate finance to MBA students and business executives. As an academic and a consultant to universities and businesses throughout the world, Dr. Bertoneche is exposed to diverse business leaders and brings a global perspective and depth of experience in the finance area. Dr. Bertoneche has served on boards of more than a dozen companies. |

● | ● | |||||||||

| 4 | 2021 Proxy Statement |

|

|

Governance of the Company |

| Name/Age/Independence

|

Director Since

|

Committee Membership (C: Chair)

| ||||||||||||

| Biographies

|

Audit

|

Comp.

|

Nom.

|

ESG

| ||||||||||

|

Douglas M. Britt, 56 Independent Director |

December 2016 |

Doug Britt has been a Director of the Company since December 2016. In May of 2020, Mr. Britt became President and Chief Executive Officer of Boyd Corporation, a multinational company with a workforce of over 6,000 employees. Boyd Corporation is a global leader in engineered materials and thermal management solutions. Previously, he served as President of the Integrated Solutions division of Flex Agility (NASDAQ: FLEX), a leading sketch-to-scale™ solutions company that provides innovative design, engineering, manufacturing, real-time supply chain insight, and logistics services to companies of all sizes in various industries and end-markets. Mr. Britt recently was responsible for a $19B business within Flex Agility, which operates in over 30 countries with a workforce of over 200,000 employees. From May 2009 to November 2012, Mr. Britt served as Corporate Vice President and Managing Director of Americas for Future Electronics, and from November 2007 to May 2009, he was Senior Vice President of Worldwide Sales, Marketing, and Operations for Silicon Graphics. From January 2000 to October 2007, Mr. Britt held positions of increasing responsibility at Solectron Corporation, culminating his career there as Executive Vice President, and was responsible for Solectron’s customer business segments including sales, marketing and account and program management functions. Mr. Britt earned a bachelor’s degree in business administration from California State University, Chico, and attended executive education programs throughout Europe, including at the University of London. As an executive at multinational companies, Mr. Britt has extensive global mergers and acquisition experience, global manufacturing and supply chain expertise and a deep understanding of customer relationships and leading a global business. |

● | C | |||||||||

|

Laura Dempsey Brown, 57 Independent Director |

April 2020 |

Laura Brown retired in 2018 from W.W. Grainger, Inc. (NYSE: GWW), a leading broad line supplier of maintenance, repair and operating products after 19 years. She was the Senior Vice President, Communications and Investor Relations since 2010 reporting directly to Grainger’s CEO and Chairman. She led Grainger’s internal and external communications, public affairs and investor relations teams. Previously Ms. Dempsey Brown served as Vice President of Marketing. In addition, she led the strategy development and operational execution of Grainger’s multi-year market expansion initiative focused on the top 25 U.S. metro markets. Ms. Dempsey Brown also served as the Vice President of Finance for Grainger’s field sales, operations, marketing and e-business functions. Prior to joining Grainger, Ms. Dempsey Brown was a Vice President at Alliant Foodservice and at Dietary Products at Baxter. She began her career at Baxter in 1985 focusing primarily on financial roles in the distribution and manufacturing businesses. She graduated from Indiana University with a bachelor’s degree in accounting and obtained designation as a Certified Public Accountant in 1985. Ms. Dempsey Brown has over 17 years in finance or accounting leadership roles and has extensive knowledge in strategy, M&A, corporate governance, crisis management and general overall business acumen. |

C | ● | |||||||||

|

2021 Proxy Statement | 5 |

|

Governance of the Company |

| Name/Age/Independence

|

Director Since

|

Committee Membership (C: Chair)

| ||||||||||||

| Biographies

|

Audit

|

Comp.

|

Nom.

|

ESG

| ||||||||||

|

Cariappa (Cary) M. Chenanda, 53 Independent Director |

April 2020 |

Cary Chenanda is a Vice President and Officer of Cummins Inc. (NYSE: CMI), a global power provider, with complementary business segments that design, manufacture, distribute and service a broad portfolio of power solutions. Cummins products range from diesel, natural gas, electric and hybrid powertrains and powertrain-related components including filtration, aftertreatment, turbochargers, fuel systems, controls systems, air handling systems, automated transmissions, electric power generation systems, batteries, electrified power systems, hydrogen generation and fuel cell products. Mr. Chenanda has been with Cummins Inc. for 23 years and he currently leads their global Emission Solutions business. Prior to this role, Mr. Chenanda established and led Cummins Electronics in 2012 and in 2017, he oversaw the unification of the Cummins Electronics and Cummins Fuel System Businesses into one combined business. From 2009 to 2012, Mr. Chenanda was Executive Director for Global OE Sales and was responsible for new product development at Cummins Filtration in Nashville, TN. From 2007 to 2009, he was the General Manager for the Cummins-Scania Fuel Systems Joint Venture and managed the Fuel Systems startup in Wuhan, China. Between 1998 and 2007, Mr. Chenanda had roles with increasing responsibility in engineering, marketing and purchasing within the Engine Business. Mr. Chenanda has also worked for Ecolab and Robert Bosch GmbH. He is a Certified Purchasing Manager, a certified Six Sigma Green Belt and holds 7 United States patents. Mr. Chenanda holds an MBA from Indiana University’s Kelly School of Business, an MS in Mechanical Engineering from Texas A&M University and a Bachelor’s in Mechanical Engineering from the University of Mysore, India. Mr. Chenanda also currently serves on the Industry Advisory Council for Texas A&M’s Mechanical Engineering. |

● | ● | C | ||||||||

|

Josef Matosevic, 49 President, Chief Executive Officer and Director

Non-Independent Director |

June 2020 |

Josef Matosevic became President and Chief Executive Officer of the Company on June 1, 2020. Prior to joining the Company, he had served as Executive Vice President and Chief Operating Officer of Welbilt, Inc. (NYSE: WBT), a global manufacturer of commercial foodservice equipment, since August 2015. Mr. Matosevic also served as interim President and CEO at Welbilt, Inc. from August through November 2018. Previously, he held the role of Senior Vice President of Global Operational Excellence at The Manitowoc Company, Inc. (NYSE: MTW), a world leading provider of engineered lifting solutions, from 2014 to 2015, and as Executive Vice President of Global Operations from 2012 to 2014. Prior to joining MTW, Mr. Matosevic served in various executive positions with Oshkosh Corporation (NYSE: OSK), a designer, manufacturer and marketer of a broad range of specialty vehicles and vehicle bodies, from 2007 through 2012. Mr. Matosevic also served as its Executive Vice President, Global Operations from 2010 to 2012, with responsibility for the defense segment, companies global operating systems and lean deployment. He previously served as Vice President of Global Operations from 2005 to 2007 and Chief Operating Officer from 2007 to 2008 at Wynnchurch Capital/Android Industries, a sub-assembler, distributor and sequencer of complex engineered modules for automotive original equipment manufacturers. Mr. Matosevic has over 26 years of global operating and business experience, with skills and focus on Commercial Sales, M&A, Strategic Operating Systems, Lean Six Sigma practices, automation, and supply chain development. Mr. Matosevic holds a bachelor’s degree from Bayerische Julius-Maximilian’s Universität in Würzburg, Germany. |

|||||||||||

| 6 | 2021 Proxy Statement |

|

|

Governance of the Company |

| Name/Age/Independence

|

Director Since

|

Committee Membership (C: Chair)

| ||||||||||||

| Biographies

|

Audit

|

Comp.

|

Nom.

|

ESG

| ||||||||||

|

Alexander Schuetz, 54 Independent Director |

June 2014 |

Alexander Schuetz serves as CEO of Knauf Engineering GmbH, an engineering company in the gypsum based construction materials industry. Dr. Schuetz is currently responsible for a portfolio of multinational projects with a total volume of $500 million. Prior to joining Knauf in February 2009, Dr. Schuetz held various management positions for more than 10 years in Finance, Business Development, Mergers & Acquisitions, Project Management and General Management in the fluid power industry at Mannesmann and Bosch Rexroth, including as CEO of Rexroth Mexico and Central America from August 2000 to August 2007. From 1998 to 2000, he was based in Beijing, China and was responsible for the Finance, Tax and Legal division at Mannesmann (China) Ltd., the holding company for a number of affiliated companies of the Mannesmann Group, including Rexroth, Demag, Sachs and VDO. Dr. Schuetz holds a Ph.D. in international commercial law from the University of Muenster, Germany. In 2003, Dr. Schuetz completed the Robert Bosch North America International General Management Program at Carnegie Mellon University. Dr. Schuetz has served as a Director of the Company since June 2014. With more than ten years working in the fluid power industry, Dr. Schuetz has his career in high level corporate positions with a special focus on corporate strategies, and M & A. Since 2009, Dr. Schuetz has successfully set up gypsum plants in multiple countries. Dr. Schuetz brings a wealth of experience in major growth regions of the world, including Asia and Latin America and global insights into markets and customers to the Company, including the hydraulics industry. |

● | C | |||||||||

|

Gregory C. Yadley, 71 Independent Director |

April 2020 |

Gregory Yadley has practiced corporate and securities law for over 40 years and has been a partner with Shumaker, Loop & Kendrick, LLP, a full-service law firm, since January 1993. Prior to entering private practice, he served as Branch Chief at the U.S. Securities and Exchange Commission and Assistant General Counsel for the Federal Home Loan Mortgage Corporation, both in Washington, D.C. Mr. Yadley currently serves as a member of the SEC’s Advisory Committee on Small Business Capital Formation. He is a graduate of Dartmouth College and the George Washington University Law School. Mr. Yadley brings to the Board broad experience with respect to securities, corporate governance, financing transactions, mergers and acquisitions, internal investigations, contract negotiations and disputes, strategic planning, and general corporate matters. Mr. Yadley has advised more than a dozen public companies with respect to corporate, securities, internal investigations and other matters. Mr. Yadley has helped draft provisions of and amendments to the Florida Business Corporation Act for more than 35 years and has served as an expert witness for major national law firms in corporate and legal matters. He currently serves and has served as Chair or a member of numerous not-for-profit and civic boards of directors. |

● | ● | |||||||||

|

2021 Proxy Statement | 7 |

|

Governance of the Company |

| Name/Age |

Executive Officer Since |

Biographies | ||||

|

|

Josef Matosevic, 49, President, Chief Executive Officer and Director |

June 2020 |

Josef Matosevic became President and Chief Executive Officer of the Company on June 1, 2020. Prior to joining the Company, he had served as Executive Vice President and Chief Operating Officer of Welbilt, Inc. (NYSE: WBT), a global manufacturer of commercial foodservice equipment, since August 2015. Mr. Matosevic also served as Interim President and CEO of Welbilt, Inc. from August through November 2018. Previously, he held the role of Senior Vice President of Global Operational Excellence at The Manitowoc Company, Inc. (NYSE: MTW), a capital goods manufacturer, from 2014 to 2015, and as Executive Vice President of Global Operations from 2012 to 2014. Prior to joining MTW, Mr. Matosevic served in various executive positions with Oshkosh Corporation (NYSE: OSK), a designer, manufacturer and marketer of a broad range of specialty vehicles and vehicle bodies, from 2007 through 2012. Mr. Matosevic also served as its Executive Vice President, Global Operations from 2010 to 2012, with responsibility for the defense segment, companies global operating systems and lean deployment. He previously served as Vice President of Global Operations from 2005 to 2007 and Chief Operating Officer from 2007 to 2008 at Wynnchurch Capital/Android Industries, a sub-assembler, distributor and sequencer of complex engineered modules for automotive original equipment manufacturers. Mr. Matosevic has over 26 years of global operating and business experience, with skills and focus on Commercial Sales, M&A, Strategic Operating Systems, Lean Six Sigma practices, automation, and supply chain development. Mr. Matosevic holds a bachelor’s degree from Bayerische Julius-Maximilian’s Universität in Würzburg, Germany. | |||

|

|

Tricia Fulton, 54 Chief Financial Officer |

March 2006 |

Tricia Fulton joined the Company in March 1997 and held positions of increasing responsibility, including Corporate Controller, prior to being named Chief Financial Officer on March 4, 2006 and Interim President and Chief Executive Officer on April 5, 2020 through May 31, 2020. Her prior experience includes serving as the Director of Accounting at Plymouth Harbor from 1995-1997, various financial capacities for Loral Data Systems from 1991-1995 and as an auditor at Deloitte & Touche from 1989 to 1991. Ms. Fulton is a graduate of Hillsdale College and the General Management Program at the Harvard Business School. She served as a member of the Board of Directors for the National Fluid Power Association from 2011-2019 and as the Chairwoman of the Board for the 2016-2017 term. | |||

|

|

Matteo Arduini, 48 President QRC |

June 2019 |

Matteo Arduini was appointed General Manager of Faster S.r.l., a European manufacturer of quick release couplings, in January of 2019, after having served as Faster’s Chief Financial Officer beginning in April of 2018. From September 2012 to April 2018, Mr. Arduini was with Brevini /Dana Incorporated (NYSE: DAN). He served as the CFO of the Brevini Group and the project leader in Dana’s acquisition of Brevini Group. For one and a half years after the acquisition, he served as Head of Finance in Dana Brevini Italy. Mr. Arduini graduated from the University of Parma in 1998 with a degree in Economics and gained professional experience through roles at Ernst & Young, Ferrari Cars and Technogym. | |||

| 8 | 2021 Proxy Statement |

|

|

Governance of the Company |

| Name/Age |

Executive Officer Since |

Biographies | ||||

|

|

Jinger McPeak, 45 President, Electronic Controls |

December 2016 |

Jinger McPeak served as Co-General Manager of Enovation, which was acquired by the Company on December 5, 2016, and operates as a separate, standalone subsidiary. Ms. McPeak has had oversight and management of all aspects of the Electronics segment since December of 2016, producing and improving quality of earnings and continued progress of strategic initiatives. On April 5, 2019, Ms. McPeak assumed full leadership responsibilities for Enovation. She joined the predecessor company to Enovation in September 2004. In the 15 years with the company, Ms. McPeak has served in roles spanning from Market Management to Engineering, including leadership of the company-wide Display Solutions Team. Prior to the acquisition Ms. McPeak was the Vice President of Vehicle Technologies. She has over 20 years of experience and has been responsible for all aspects of managing the critical success factors of Enovation’s display and controller technology serving the recreational, marine and off-highway segments. Prior to joining the company, Ms. McPeak was employed at Mercury Marine, a Brunswick division, from May 1997 to September 2004 where she held several leadership positions, including Quality Engineer, Sales Administration Manager, Lean Six Sigma Program Officer and National Sales Manager. Her background includes a strong focus on market development and product portfolio strategy, including product quality & performance, program planning, timing and management, executive communication of strategic direction and tactical planning at all corporate levels. Ms. McPeak completed her education in 2001 by adding an MBA from Oklahoma State University to her Bachelor of Arts degree in Statistics. She currently serves on the BoatPAC board of the National Marine Manufacturers Association. | |||

|

|

Melanie Nealis, 46 Chief Legal and Compliance Officer and Secretary |

July 2018 |

Melanie Nealis joined the Company in July 2018 and brings over two decades of experience in legal and human resources to the Company. She currently serves as the Chief Legal and Compliance Officer and Secretary for the organization and its subsidiaries. She is responsible for managing the legal and compliance activities of the enterprise on a global basis. Prior to joining the Company, Ms. Nealis was the Deputy General Counsel of Roper Technologies, Inc. (NYSE:ROP) from 2012 to 2018 and senior corporate counsel to Nordson Corporation (NASDAQ:NDSN) from 2005 to 2012. In both of her previous in-house roles, Ms. Nealis was responsible for managing legal services and compliance programs globally. Her responsibilities included: mergers & acquisitions, litigation management, developing and administering compliance programs, labor & employment, commercial contracts, global trade advice and compliance, and other regulatory and compliance activities. Ms. Nealis graduated with a BSBA, summa cum laude, from Xavier University and has a Juris Doctorate degree from the Ohio State University Moritz College of Law, where she graduated with honors in law. Prior to her in-house roles, Ms. Nealis was in private practice in Cleveland, Ohio, beginning her career at the national law firm of Baker & Hostetler LLP. Before becoming an attorney, Ms. Nealis worked as a human resource professional at the Timken Company in Canton, Ohio. | |||

|

2021 Proxy Statement | 9 |

|

Governance of the Company |

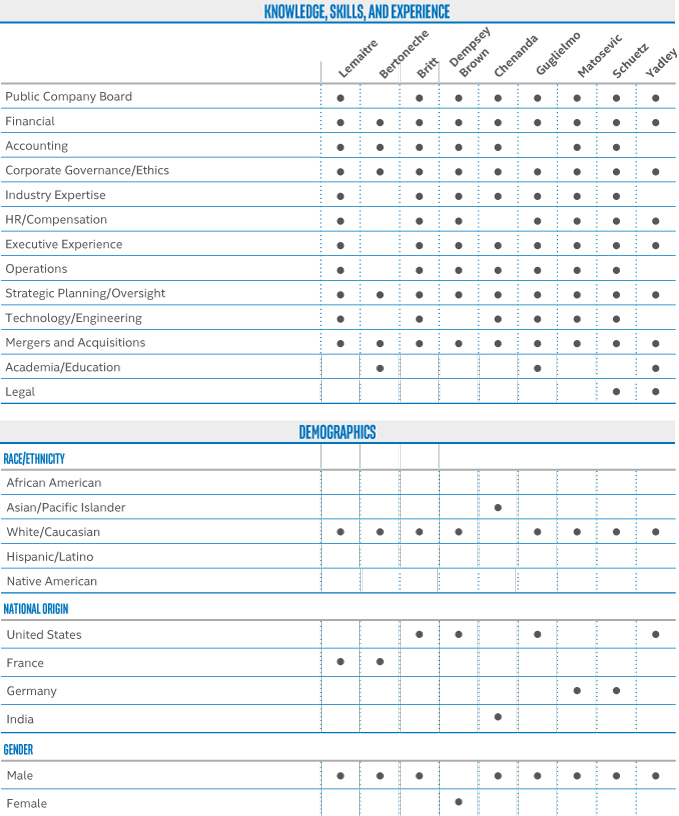

Board Skills and Diversity Matrix

The below matrix summarizes the skills and diversity demographics of our Board of Directors in 2020.

| 10 | 2021 Proxy Statement |

|

|

Governance of the Company |

Board Leadership Structure and the Board’s Role in Risk Oversight

The Board acts as a collaborative body that encourages broad participation of each of the Directors at Board meetings and in the committees, described below, on which they serve. The Board believes that a majority of Directors should be independent. The independent directors meet informally, and they also meet in regular executive sessions of the Board. The Company currently separates the functions of Chairman of the Board and Chief Executive Officer. The Chairman of the Board, who is a non-management, independent director, chairs the meetings of the Board, serves as a nonvoting ex officio member of each of the Board committees and is a member of the Nominating committee. He approves the agenda for each meeting, after soliciting suggestions from management and the other Directors. Given the size of the Company, its international operations and its culture of individual initiative and responsibility, the Board believes that its leadership structure is appropriate. The Board believes that a governing body comprised of a relatively small number of individuals with diverse backgrounds in terms of geographic, cultural and subject matter experience, strong leadership and collaborative skills, is best equipped to oversee the Company and its management.

The Company’s culture emphasizes individual integrity, initiative and responsibility. The Company’s compensation structure does not encourage individuals to undertake undue risk for personal financial gain. The Board has delegated to the Audit Committee the responsibility for financial risk and fraud oversight, to consider for approval all transactions involving conflicts of interest and to monitor compliance with the Company’s Code of Business Conduct and Ethics (“Code”).

The Governance and Nominating Committee has historically addressed non-financial risks, including political and economic risks, risks relating to the Company’s growth strategy, and current business risks on a quarterly basis, and makes recommendations to the Board with respect to those and other risks, including leadership development and succession. In March 2021, the Board created a new Environmental, Social and Governance (“ESG Committee”). The new ESG committee will address risk previously overseen by the Governance and Nominating Committee related to the global enterprise. To supplement the reports of the former Governance and Nominating Committee and now the ESG Committee, the Chief Executive Officer reports to the full Board, at least annually, regarding material risks facing the Company, risks it may face in the future, measures that management has employed to address those risks and other information relating to how risk analysis is incorporated into the Company’s corporate strategy and day-to-day business operations.

As part of its risk oversight and compliance responsibilities, the Board, in December 2018, adopted a new Code that serves as an overarching document to supplement similar policies adopted by its subsidiaries. The Code has been translated into seven languages, and training programs are held to ensure the code is understood and observed throughout the Company. In July 2018, the Board appointed a Chief Legal and Compliance Officer (“CLCO”) who oversees and manages the legal and compliance functions of the Company on a global basis. In January 2021, the Board approved minor revisions to the Code and the updated Code was communicated to all Helios employees globally.

Independence and Committees of the Board of Directors

At its meeting on March 10, 2021, the Board undertook a review of Director Independence. Except as described under “Certain Relationships and Related Transactions,” it was determined that there were no transactions or relationships between any of the Directors or any member of the Directors’ immediate families and the Company and its subsidiaries and affiliates. The purpose of this review was to determine the independence of each of the Directors under the rules of the Nasdaq Stock Market and, for audit committee and compensation committee members, also under the heightened independence standards of the SEC. The Board determined that Messrs. Bertoneche, Britt, Chenanda, Lemaitre, Schuetz, Yadley and Ms. Dempsey Brown, qualify as independent directors under both the rules of the Nasdaq Stock Market and the SEC. In December 2020, the Board reevaluated the independence of Dr. Guglielmo and determined that Dr. Guglielmo did not meet the independence rules of Nasdaq and as a result he was removed from all Committees of the Board and served the remainder of his term as a member “at large.”

In considering the independence of Messrs. Yadley and Chenanda, the Board took into consideration the transactions set forth under “Certain Relationships and Related Transactions,” as well as certain other customer contracts with Cummins in which Mr. Chenanda does not have a material interest. The Board concluded that Messrs. Yadley and Chenanda qualify as independent under the rules of Nasdaq. By virtue of his position as President and Chief Executive Officer of the Company, the Board has concluded that Mr. Matosevic does not qualify as independent.

|

2021 Proxy Statement | 11 |

|

Governance of the Company |

In 2020, the Board had three standing committees, which are listed below. The current composition of the three standing committees is included in the table set forth under the heading “Directors and Executive Officers.”

As discussed below under “Oversight of Environmental, Social and Governance (ESG) Matters,” on March 10, 2021, the Board formally memorialized the Company’s commitment to fundamental ethical principles, including diversity and respect for the dignity of every individual, in the form of the ESG Committee, which will assume the responsibility for overseeing the Company’s corporate governance practices, as well as social, environmental, enterprise risk and other matters. The Governance and Nominating Committee was recast as the Nominating Committee and will continue to nominate Directors with diverse backgrounds in terms of geographic, cultural and subject matter experience, as well as gender, race, national origin and other diverse characteristics, that are complementary to those of the other Directors so that, as a group, the Board will possess the appropriate talent, skills and expertise to oversee the Company’s business.

Audit Committee

The Audit Committee, currently comprised of Laura Dempsey Brown (Chair), Marc Bertoneche, Cary Chenanda and Doug Britt held nine meetings in 2020. The Board determined, under applicable SEC and Nasdaq rules, that all of the members of the Audit Committee are independent and that Dr. Bertoneche meets the qualifications as an Audit Committee Financial Expert, and he has been so designated. During 2020, the following Board members served on the Audit Committee in addition to those currently serving: Alexander Schuetz (Chair through October 2020) and Kennon Guglielmo. Each of the current members of the Audit Committee satisfies the heightened independence standards of Rule 10A-3 under the Exchange Act. The functions of the Audit Committee are to select the independent public accountants who will prepare and issue an audit report on the annual financial statements of the Company and a report on the Company’s internal controls over financial reporting, to establish the scope of and the fees for the prospective annual audit with the independent public accountants, to review the results thereof with the independent public accountants, to review and approve non-audit services of the independent public accountants, to review compliance with existing major accounting and financial policies of the Company, to review the adequacy of the financial organization of the Company, to review management’s procedures and policies relative to the adequacy of the Company’s internal accounting controls, to review areas of financial risk and provide fraud oversight, to review compliance with federal and state laws relating to accounting practices and to review and approve transactions, if any, with affiliated parties. It also invites and investigates reports regarding accounting, internal accounting controls or auditing irregularities or other matters.

The Audit Committee reviews management’s monitoring of the Company’s compliance with its Code, including its confidential ethics reporting hotline and the periodic review and update of the Code. No waivers of the Company’s Code were requested or granted during the year ended January 2, 2021. The Code is available on the Investors page of our website www.heliostechnologies.com and from the Company upon written request sent to the Corporate Secretary, 1500 West University Parkway, Sarasota, Florida 34243.

The Audit Committee is governed by a written charter approved by the Board. The charter is available on the Investors page of our website www.heliostechnologies.com and from the Company upon written request sent to the Corporate Secretary, 1500 West University Parkway, Sarasota, Florida 34243.

Compensation Committee

The Compensation Committee is currently comprised of Douglas M. Britt (Chair), Marc Bertoneche, Alexander Schuetz and Gregory Yadley. In 2020, the following Board members also served on the Compensation Committee: Laura Dempsey Brown, Cary Chenanda, Christine Koski and Kennon Guglielmo. Each of the current members of the Compensation Committee satisfies the heightened independence standards of Rule 10C-1 under the Exchange Act. The Compensation Committee oversees the Company’s compensation program, including executive compensation and the review, approval and recommendation to the Board of the terms and conditions of all employee benefit plans or changes thereto. The Committee administers the Company’s equity incentive and non-employee director fees plans and carries out the responsibilities required by the rules of the SEC. The Compensation Committee met six times during 2020.

The Compensation Committee is governed by a written charter approved by the Board. The charter is available on the Investors page of our website www.heliostechnologies.com and from the Company upon written request sent to the Corporate Secretary, 1500 West University Parkway, Sarasota, Florida 34243.

| 12 | 2021 Proxy Statement |

|

|

Governance of the Company |

Governance and Nominating Committee

The Governance and Nominating Committee, comprised in 2020 of Alexander Schuetz (Chair), Cary Chenanda, Philippe Lemaitre, and Gregory Yadley, held four meetings in 2020. The following Board members also served on the Governance and Nominating Committee during 2020: Kennon Guglielmo, Christine Koski, and Doug Britt. The primary purpose of the Committee in 2020 was to identify and recommend to the Board individuals qualified to become members of the Board, consistent with criteria approved by the Board, develop and recommend to the Board corporate governance guidelines and policies for the Company, and monitor the Company’s compliance with good corporate governance standards. The Committee also addressed non-financial risks, including development and succession of leadership, and made recommendations to the Board with respect to those and other risks facing the Company.

The Governance and Nominating Committee is governed by a written charter approved by the Board. The charter is available on the Investors page of our website www.heliostechnologies.com and from the Company upon written request sent to the Corporate Secretary, 1500 West University Parkway, Sarasota, Florida 34243. With the reconstitution of the Committees to include the ESG Committee in 2021, the new Nominating Committee and ESG Committee Charters are expected to be adopted at the next meeting of the Board, to be held on June 3, 2021.

The Board has adopted a Statement of Policy Regarding Director Nominations, setting forth qualifications of Directors, procedures for identification and evaluation of candidates for nomination, and procedures for recommendation of candidates by shareholders.

As set forth in the Statement of Policy, a candidate for Director should meet the following criteria:

| • | must, above all, be of proven integrity with a record of substantial achievement; |

| • | must have demonstrated ability and sound judgment that usually will be based on broad experience; |

| • | must be able and willing to devote the required amount of time to the Company’s affairs, including attendance at Board and committee meetings and the annual shareholders’ meeting; |

| • | must possess a judicious and somewhat critical temperament that will enable objective appraisal of management’s plans and programs; and |

| • | must be committed to building sound, long-term Company growth. |

Other than the foregoing, the Board does not believe there is any single set of qualities or skills that an individual must possess to be an effective Director or that it is appropriate to establish any specific, minimum qualifications for a candidate for election as a Director. Rather, the Committee will consider each candidate in light of the strengths of the other members of the Board and the needs of the Board and the Company at the time of the election.

The Board of Directors adheres to the “Rooney Rule” with respect to its consideration of board candidates. The Board is committed to considering multiple diverse candidates in evaluating any vacancy on the Board to underscore Helios’s commitment to diversity.

The Committee will take whatever actions it deems necessary under the circumstances to identify qualified candidates for nomination for election as a member of the Board, including the use of professional search firms, recommendations from Directors, members of senior management and security holders. All such candidates for any particular seat on the Board shall be evaluated based upon the same criteria, including those set forth above and such other criteria as the Committee deems suitable under the circumstances existing at the time of the election.

At its meeting on March 5, 2020, the Governance and Nominating Committee unanimously recommended two new candidates for nomination to the Board for the class of directors whose term expires in 2023, Ms. Dempsey Brown and Mr. Chenanda. Additionally, at its meeting on April 20, 2020, the Governance and Nominating Committee unanimously recommended one new candidate, Mr. Yadley, for nomination to the Board for the class of directors whose term expires at the 2021 Annual Meeting. Ms. Dempsey Brown, Mr. Chenanda and Mr. Yadley possess talent, skill sets and qualifications that align with the criteria for Board service as set forth in the Statement of Policy above. Additionally, on May 15, 2020, the

|

2021 Proxy Statement | 13 |

|

Governance of the Company |

Company announced publicly that an offer of employment was extended to and accepted by Mr. Josef Matosevic to assume the role of President and Chief Executive Officer of the Company. Mr. Matosevic’s appointment was effective June 1, 2020. Mr. Matosevic was appointed to the Board in connection with his assumption of this role on June 1, 2020, in the class of directors whose term expires at the 2021 Annual Meeting. The Governance and Nominating Committee unanimously recommended Mr. Matosevic’s nomination to the Board and concluded he possesses the talent, skill set and qualifications that align with the criteria for Board service stated above.

At its meeting on March 5, 2021, the Governance and Nominating Committee unanimously recommended to the Board that Mr. Matosevic and Mr. Yadley be nominated to serve in the class of directors whose term expires at the 2024 Annual Meeting. Mr. Matosevic and Mr. Yadley possess the talent, skill sets, and qualifications that align with the criteria for Board service as set forth in the Statement of Policy above. The Board unanimously adopted the recommendation of the Committee. Following the reconstitution of the Committees at the Board’s meeting on March 10, 2021, the members of the new ESG committee are: Mr. Chenanda (Chair), Ms. Dempsey Brown, and Mr. Yadley. The Nominating Committee members are: Dr. Schuetz (Chair), Mr. Chenanda, and Mr. Lemaitre.

Shareholder Recommendations for Nomination as a Director

In order for the Committee to consider a candidate recommended by a shareholder, the shareholder must provide to the Corporate Secretary, at least 120, but not more than 150, days prior to the date of the shareholders’ meeting at which the election of Directors is to occur, a written notice of such security holder’s desire that such person be nominated for election at the upcoming shareholders meeting; provided, however, that in the event that less than 120 days’ notice or prior public disclosure of the date of the meeting is given or made to shareholders, notice by the shareholder to be timely must be received not later than the close of business on the tenth business day following the day on which such notice of the date of the meeting was mailed or such public disclosure was made, whichever first occurs.

A shareholder’s notice of recommendation must set forth:

| (a) | as to each person whom the shareholder proposes be considered for nomination for election as a Director |

| (i) | the name, age, business address and residence address, |

| (ii) | his or her principal occupation or employment during the past five years, |

| (iii) | the number of shares of Company common stock he or she beneficially owns, |

| (iv) | any other information relating to the person that is required to be disclosed in solicitations for proxies for election of Directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended, and |

| (v) | the consent of the person to serve as a Director, if so elected; and |

| (b) | as to the shareholder giving the notice |

| (i) | the name and record address of shareholder, |

| (ii) | the number of shares of Company common stock beneficially owned by the shareholder, |

| (iii) | a description of all arrangements or understandings between the shareholder and each proposed nominee and any other person pursuant to which the nominations are to be made, and |

| (iv) | a representation that the shareholder intends to appear in person or by proxy at the meeting to nominate the person(s) named. |

| 14 | 2021 Proxy Statement |

|

|

Governance of the Company |

Director Participation and Relationships

2020 presented unprecedented challenges for the Company, necessitating an increased number of Board meetings. Consequently, the Board held fifteen meetings during 2020 (the majority were telephonic), and all of the Directors who served in 2020 were present at each meeting. Each Director also attended all of the meetings of each committee of which he or she was a member in 2020.

The Board has adopted a policy stating that it is in the best interests of the Company that all Directors and nominees for Director attend each annual meeting of the shareholders of the Company. The policy provides that the Board, in selecting a date for the annual shareholders meeting, will use its best efforts to schedule the meeting at a time and place that will allow all Directors and nominees for election as Directors at such meeting to attend the meeting. The policy further provides that an unexcused absence under the policy should be considered by the Governance and Nominating Committee in determining whether to nominate a Director for re-election at the end of his or her term of office. All of the Directors attended last year’s annual meeting of shareholders.

No family relationships exist between any of the Company’s Directors and executive officers. There are no arrangements or understandings between Directors and any other person concerning service as a Director.

Compensation Committee Interlocks and Insider Participation

During fiscal 2020, Marc Bertoneche, Douglas M. Britt, Laura Dempsey Brown, Cary Chenanda, Kennon Guglielmo, Christine L. Koski, Alexander Schuetz and Gregory Yadley served on the Compensation Committee. None of the current members of the Compensation Committee has been an officer or employee of our Company. Additionally, none of our executive officers serve as a member of the board of directors or compensation committee of any other entity that has one or more executive officers serving as a member of our Board or Compensation Committee.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s Directors, officers and holders of more than 10% of the Company’s Common Stock to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and any other equity securities of the Company. To the Company’s knowledge, based solely upon a review of the forms, reports and certificates filed with the Company by such persons, all of the Company’s Directors, officers, and holders of more than 10% of the Company’s Common Stock complied with the Section 16(a) filing requirements in 2020, except for Alexander Schuetz, who filed one Form 4 late.

Communications with the Board of Directors

Shareholders and other parties interested in communicating with our Board may do so by writing to the Board, Helios Technologies, Inc., 1500 West University Parkway, Sarasota, Florida 34243. Under the process for such communications established by the Board, the Chairman of the Board reviews all such correspondence and regularly forwards it, or a summary of the correspondence, to all of the other members of the Board. Directors may at any time review a log of all correspondence received by the Company that is addressed to the Board or any member of the Board and request copies of any such correspondence. Additionally, correspondence that, in the opinion of the Chairman, relates to concerns or complaints regarding accounting, internal accounting controls and auditing matters is forwarded to the Chair of the Audit Committee.

Environmental, Social and Governance (ESG) Matters

In 2020, Helios and its Board affirmed its commitment to ESG matters as an integral part of the Company’s business strategy. To underscore its commitment, the Board recently created a new Committee entitled “Environmental, Social and Governance,” whose charter will be to assist the Company in its oversight of corporate social responsibilities, significant public policy issues, health and safety, and climate-change related trends and other global ESG matters in addition to overseeing all corporate governance matters pertaining to the Company.

|

2021 Proxy Statement | 15 |

|

Governance of the Company |

Additionally, the Board adopted several new policies and procedures that underscore its commitment to ESG matters. Highlights include:

|

ESG Policy & Procedure Highlights

| ||

|

• Corporate Responsibility Policy (including Human Rights Policy)

• Code of Conduct for Suppliers and Third-Party Vendors (including Policy Against Human Trafficking & Slavery |

• Conflict Mineral Policy

• Anti-Hedging Policy (Update)

• Code of Business Conduct and Ethics (“Code”) (Update)

| |

As summarized below, 2020 was a year of significant progress towards ESG goals for Helios across the globe.

GOVERNANCE/BUSINESS CONDUCT

Helios is committed to conducting our business with ethics and integrity. This expectation is memorialized in the policies and procedures applicable to our employees, vendors, and partners across the globe. All our operating companies maintain their own individual ethics and code of conduct policies, the collective policies of which are also incorporated into our corporate policy, the Code. In 2020, every Helios employee across the globe was required to complete an ethics training course and to acknowledge the Code. In addition, Helios companies maintain ethical and conduct standards for their suppliers across the globe and require all suppliers to execute a Code of Conduct for Suppliers and Third-Party Vendors. In 2020, we required all employees who interact with third party suppliers to attend a training session on the prevention of human trafficking and slavery in our supply chain.

Helios maintains a confidential ethics and reporting hotline that can be accessed by employees all over the globe (heliostechnologies.ethicspoint.com). Both the Audit and ESG Committees of the Board oversee the ethics and compliance programs of the Company. Our Chief Legal and Compliance Officer oversees our ethics and compliance programs and provides advice and counsel on a regular basis to Helios and its employees on these topics.

Information Security Disclosure

Our Board remains active in reviewing our information security exposure and risks. In 2020, our Governance and Nominating Committee, composed of all independent Directors, was responsible for reviewing our information security risks quarterly. Some of our Directors have information security experience and have the knowledge and skills to provide valuable guidance. Beginning in 2021, the same responsibility will move to the newly formed ESG committee. Our Board also receives a comprehensive review of information security measures annually.

In 2020, Helios bolstered its Cyber Security posture by implementing a three-tiered security strategy, focusing on user training, email hygiene, and real-time monitoring. This strategy also assists in identifying and mitigating information security risks. To address user training, Helios implemented a cyber security training platform to raise employee awareness across all its businesses. These trainings are delivered monthly and provide trainings ranging from password best practices to recognizing malicious links. Additionally, Helios has standardized a powerful email filter, protecting users and recipients from dangerous email attachments. Further, Helios implemented a powerful 24/7 security operations center (SOC) to monitor every Helios computer system in real-time and alert the IT team of any potential danger. The SOC also utilizes a preconfigured IT “playbook” to automatically neutralize threats based on predetermined criteria. Together, these tiers of security greatly reduce the Helios attack surface. Helios has not experienced a material information security breach in the last three years.

Responsible Corporate Funding

Consistent with the policies set forth in our Code, Helios does not use any corporate funds for the purposes of political advocacy. We recognize that using corporate funds for political advocacy is restricted in many territories. Helios identifies using corporate funds for political advocacy purposes as making donations or payments for lobbying, campaign contributions, or contributions to tax-exempt groups including trade associations.

In 2020, Helios did not use any corporate funds to engage in political advocacy with any individual, group, trade association, or political entity.

| 16 | 2021 Proxy Statement |

|

|

Governance of the Company |

Environmental and Social Responsibilities Matters

Since its inception, Helios has developed business policies and practices that support our business model and philosophy of running an ethical organization that embraces its corporate citizenship responsibilities. During 2020, a highly unusual year, our business responded with both a socially responsible and environmental approach.

Our focus:

| • | Giving back to our planet by becoming more energy efficient and environmentally friendly; |

| • | Giving back to our communities, supporting their causes during an eventful season of political, social and health unrest; |

| • | Giving back to our employees by driving inclusivity, diversity and equity in the workplace; and |

| • | Giving back to our shareholders, aligning our governance practices to their interests and vision. |

Our commitment to sustainable, ever-evolving efforts in the areas of environmental and social responsibility is clearly outlined by the allocation of resources that we dedicate to ensure we can have a focused approach to planning, execution, continuous improvement, auditing and tracking of our environmental, social and governance (ESG) efforts.

ENVIRONMENTAL RESPONSIBILITY

| In 2020, Helios made several strides in its efforts to be responsible stewards of the environment. Our commitment was underscored by the creation of a new role, Senior Vice President of Global Manufacturing Operations. In this role, our senior VP will take a holistic approach to our operations as they relate to cost, quality, |

|

|

|

| ||||

| safety and environmental stewardship. This position will have the main oversight responsibility to ensure Helios provides enhanced disclosure on environmental issues and that it continues its new direction of a targeted approach to address risk and material concerns in the way we design, manufacture and deliver our products while eliminating risks to shareholders and their financial interests and promoting leadership accountability. Further, as detailed below, Helios companies across the globe had tangible results in the elimination of waste, reducing our carbon footprint, and being good stewards to our environment. | ||||||||

TALENT DEVELOPMENT, DIVERSITY, INCLUSION AND COMPENSATION

| We believe that human resource management’s material impact to our business cannot be overstated. From the increase of employee productivity through engagement and a positive work environment to the bottom line impact the reduction of turnover can have, it is our intention to continue self-assessing and developing our ability to thrive in how we manage this critical aspect of our operation. |

|

|

|

In 2020, Helios continued its commitments to talent development, diversity, inclusion and fair compensation practices. As set forth in the Company’s Code of Conduct & Business Ethics and the Corporate Responsibility Policy, Helios is committed to workplaces free of discrimination or harassment of any kind and focused on increasing diversity. As highlighted below, the Helios companies demonstrated their commitment to these topics through policies and procedures, training, hiring practices, and corporate events.

|

2021 Proxy Statement | 17 |

|

Governance of the Company |

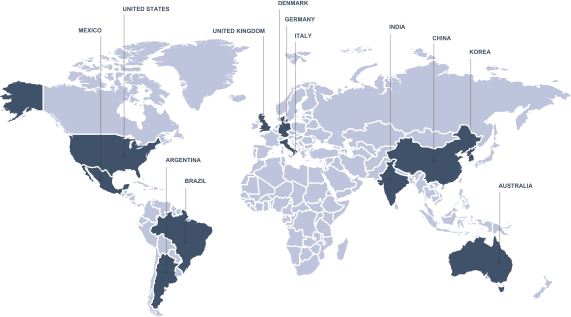

SOCIAL RESPONSIBILITY AND JUSTICE, CORPORATE CITIZENSHIP & ECONOMIC GROWTH

| In 2020, we celebrated fifty years of our pioneer business unit. Fifty years of establishing a strong presence as a corporate citizen. Although our historical commitment to enrich our local communities has never faltered, this past year’s unique social, health and financial developments |

|

|

|

| ||||

| tested our resolve to balance being active corporate citizens, delivering products to maintain lifesaving and food production applications and safeguarding our business profitability. Although we have much to celebrate, we believe that all our efforts in social matters deserve a special focus. | ||||||||

To continue to support Helios in its special focus on corporate giving, volunteerism, employee relief, and other giving, the Company has partnered with a third-party to continue guiding and expanding our efforts to take action on important social issues that allow us not only to serve our neighbors, but to tell the world where we stand on relevant ethical and social issues. This partner, with a long tenure administering the social responsibility efforts of other organizations, will support our efforts to provide relief to our own employees while also identifying service opportunities that allow us to address a variety of social needs within our communities. It will also help us to track our actions and investment to deliver these services, creating public confidence and goodwill and mitigating the risk that negative publicity and potentially costly litigation can have in instances where an organization fails to take action or fulfill their duty on important social issues. Inappropriately managed social risks can also be detrimental to the value of a business and a threat to shareholder value. Our new program will help us with the oversight of these risks, as well as the effective management of our resources and those of our employees who are committed to exercise their civic and social duty in a responsible, compassionate and conscientious manner.

ENVIRONMENTAL MATTERS – OUR PLANET

| We take great pride in protecting the environment, and we want to preserve the beauty of our planet for generations to come.

Our commitment to being good stewards of our environment has continued not only with isolated energy consumptions actions, but with a systematic approach to monitoring our operations from a functionality, energy and quality perspective. Our approach focuses not only on a change in operations, but also on product design, and extending our energy-efficiency efforts to our end users. We also established metrics and associated with industry auditing firms to certify our efforts, resulting in important designations. |

|

| 18 | 2021 Proxy Statement |

|

|

Governance of the Company |

Here are some of our most significant accomplishments:

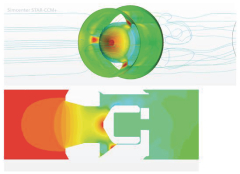

| Environmental Stewardship – Energy Efficiency

• Energy efficient product design and modification: These snapshots (pictured right) are from CFD Simulation (Computational Fluid Dynamics). There are two efficiencies gained with simulation. First, we optimize pressure drop in the valve to reduce energy consumption when the valve is in use. Second, simulation allows virtual optimization so there are fewer iterations done with real hardware, thus reducing material usage, processing, etc. This is an excellent illustration of our new way to handle product design and modification to ensure energy efficiency for us and our end users. |

|

| • | Electricity improvements: In Italy, we improved energy efficiency by changing LED lights in production areas from 6,000 to 16,800 lumens while maintaining the same consumption in Watts. In Korea, our efforts resulted in an increased electricity efficiency from 87% to 95%. |

| • | Facility updates: We improved our cooling efficiency by switching from a straight cool unit to a Variable Air Volume (VAV) system, removed an old fire suppression system and upgraded to an environmentally friendly system, upgraded all new motors to high efficiency (greater than 95%) and created electric vehicle charging stations in 2020 with more to be installed in 2021. |

| • | Energy use monitoring: Our process now includes ultrasonic checks for leak determination and replacement of various fittings to reduce compressed air losses. |

| • | Product design improvements: We established a new control scheme for test stand control, increasing efficiency, reducing energy and heat waste and resulting in lower energy consumption for our customers. |

Environmental Stewardship – Recycling

| • | Reusage: Our business units reused packaging (up to 98% reusage rate), logistics waste and shipping materials intra-company and third party, creating a highly efficient, cost-effective and environmentally friendly packing and shipping recycling program. This effort included the collection of plastic trays that were sent back to suppliers for reuse. |

| • | Paper use reduction: By inserting the Quick Response Code (QR) code on packaging, it allowed for elimination of the paper manual. Our new system of reference drawings also eliminates the need of printouts. We eliminated paper catalogs by establishing a web-enabled catalog that allows original equipment manufacturers (“OEM”) and distributors to order and submit modifications online. In addition, we introduced three new environmentally friendly models to our MultiFaster product family, reducing the use of chemical painting resulting in reduction of business cost and paper usage. |

| • | Waste reduction: We streamlined processes to drastically reduce solid scraps and oil waste. All in-house generated scraps are now sold to scrap vendors for recycling. We also redoubled recycling and scrap material management in our facilities. |

| • | Recyclable packaging: Helios business units changed packaging material for shipment from Sealed urethane foam and film to recyclable materials (paper and air cushion). Further use of urethane foam and film has been permanently discontinued as of 2020. |

| • | Facility recycling efforts: At one of our Florida facilities, we recycled 25 tons of steel, 20 tons of aluminum and 27 tons of cardboard in one year. In Italy, our “Green Together” initiative established organic food in vendor-only machines, avoiding the use of plastic, recycling and reusing material and exclusively utilizing a water dispenser to reduce paper consumption. In addition, we have fully transitioned from plastic to cardboard coffee cups in all vending machines. |

|

2021 Proxy Statement | 19 |

|

Governance of the Company |

Environmental Stewardship – Emission & Waste Reduction

|

• New technology: We received a John Deere Supplier Innovation Award for our industry-leading design that enabled a 75% reduction in leak points and purchased components on a combine harvester (pictured right).

• Process improvements: In Korea, we changed our washing method for integrated packages from a solvent/thinner product to a degreasing process. Compared to 2018, this change reduces the usage of methylene chloride from 3,000 liters to 0 liters annually.

|

| ||

| We have eliminated the use of Freon 113 in manufacturing, we are converting our warehouse forklifts from propane to electric power to reduce C02 emissions and we are converting all hand soldering operations to lead free solder. In 2020, we installed spill protection and plastic reduction in our facilities. | ||||

One of our Florida facilities successfully diverted 270,000 gallons of wastewater per year from the local sewer system.